The United States Postal Service (USPS) is blaming unexpectedly high, historic inflation for a major portion of its $6.5 billion loss in Fiscal Year (FY) 2023, which ended on September 30.

Postmaster General and CEO Louis DeJoy detailed the harmful impact of the “historical inflationary environment” during the open session meeting of the Postal Service Board of Governors held earlier this month, on November 14:

“Our efforts to grow revenue and reduce labor and transportation costs were simply not enough to overcome our costs to stabilize our organization, the historical inflationary environment we encountered, and our inability to obtain the CSRS (Civil Service Retirement System) reform we sought, none of which were accounted for in our forecasts.”

In its 10-year Delivering For America (DFA) plan (2020-30), USPS forecasted that it would break even in FY2023. Instead, it suffred the $6.5 billion net loss.

Fully $2.6 billion, or 40%, of that loss was caused by “inflation above what we expected,” DeJoy explained:

“In addition, this year’s loss includes $2.6 billion in inflation above what we projected and what we were able to recover, as our pricing adjustments are not proportional to our costs and are garnered after we have already been impacted by the inflation.”

Over the past three fiscal years (FY2021-23), inflation has cost “nearly $8 billion” more than the USPS plan had projected:

“In fact, for the 3 years since the release of the DFA Plan, we have taken what was projected to be between $34 and $39 billion in losses and reduced them by half to $18.8 billion despite incurring $7.2 billion in CSRS costs expected to be eliminated and nearly $8 billion in inflation above our planned inflation and corresponding revenue authority.”

Inflation has, indeed, run at a historically-high rate and hurt all Americans during the Biden Administration.

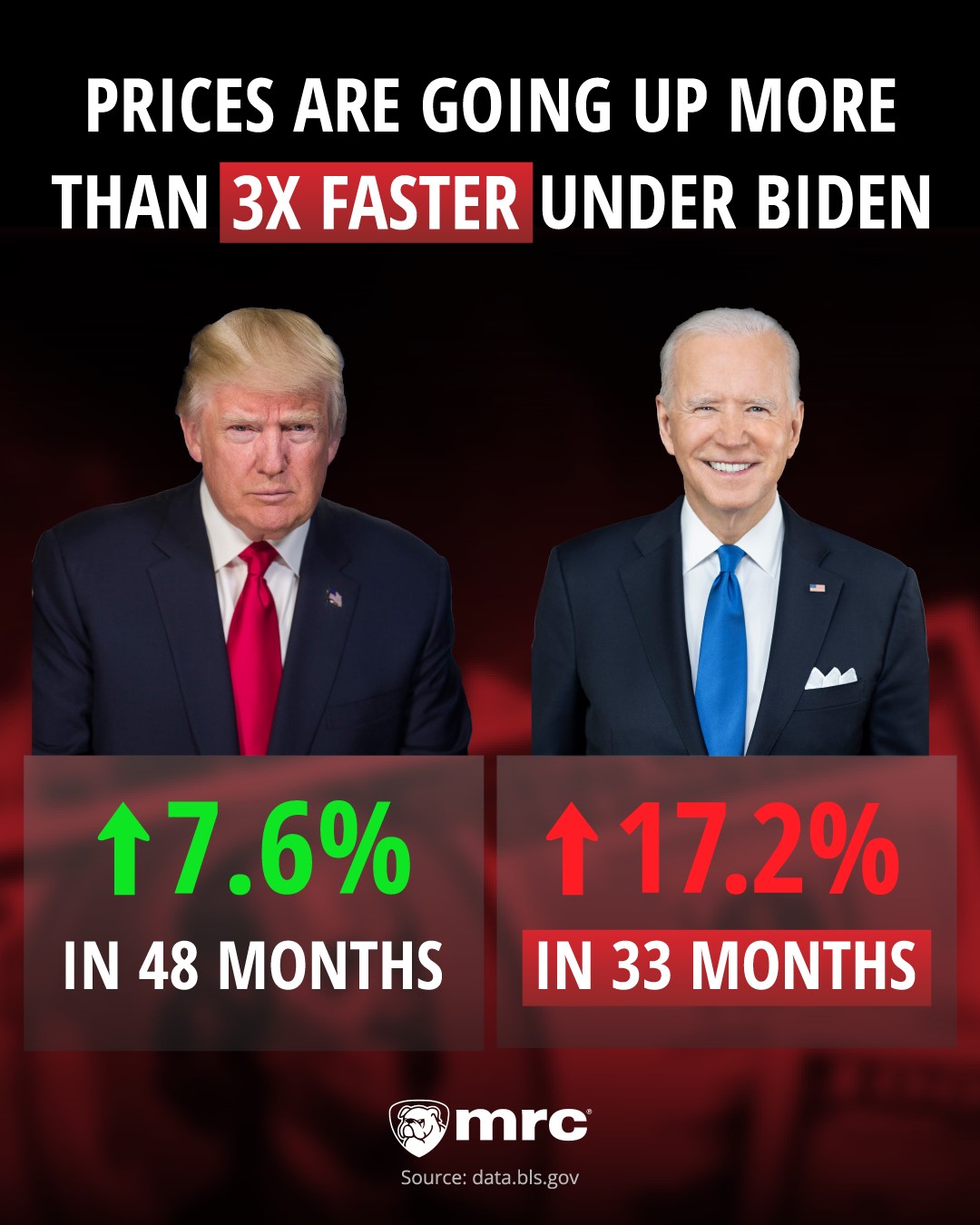

As CNSNews reported last Wednesday, prices have increased 17.2% in less than three years of Biden’s presidency:

“Consumer prices rose 7.6% in the 48 months of the Trump Administration, from a CPI of 243.618 in January 2021 to one of 262.035 in December 2020.

“In contrast, prices have already risen more than twice as much, 17.2%, in just 33 months under Biden. Slightly more than two-thirds of the way through his term, the CPI has risen from 262.650 in January of 2021 to 307.169 last month (October 2023), putting it on pace to increase more than three times as much as it did during Trump's full, four-year term. On a monthly basis, inflation averaged 1.9% under Trump, compared to 5.9% under Biden, thus far.”

Meanwhile, wages have failed to keep pace with inflation, causing “real” wages to decline so far under Biden, after increasing during the Trump Administration.