(Image via Twitter)

The Tax Foundation released a report on marijuana legalization and taxes on Thursday, finding that marijuana tax collections in Colorado and Washington far exceeded initial estimates.

Based on that data and sources of additional revenue that could come into play if marijuana is legalized nationally, the Tax Foundation predicts that “a mature marijuana industry could generate up to $28 billion in tax revenues for federal, state, and local governments.”

The study does not mention that the National Institutes of Health's (NIH) National Institute on Drug Abuse estimates the annual cost of the use of illicit drugs is $193 billion, in terms of crime, lost productivity and health care. Health care alone for those using illicit drugs currently costs society $11 billion a year.

“In those states that have fully legalized marijuana, revenue collections have exceeded initial estimates,” writes the nonprofit. “Colorado anticipated $70 million in marijuana tax collections per year, and after a slow initial start, state collections will likely exceed $140 million in calendar year 2016. In Washington, after a slow start to bring the licensing system online, sales are now averaging over $2 million a day with revenue possibly reaching $270 million per year.”

“If all states legalized and taxed marijuana, states could collectively expect to raise between $5 billion and $18 billion per year,” the Tax Foundation projects.

In addition, the federal government could generate $500 million per year with a federal tax on marijuana similar to the tax on tobacco and $5.3 billion per year with a 10% sales surtax.

Other sources of revenue would include business income from marijuana production – an estimated $5.5 billion per year – and individual income tax and payroll taxes from labor in the marijuana industry – an estimated $1.5 billion per year.

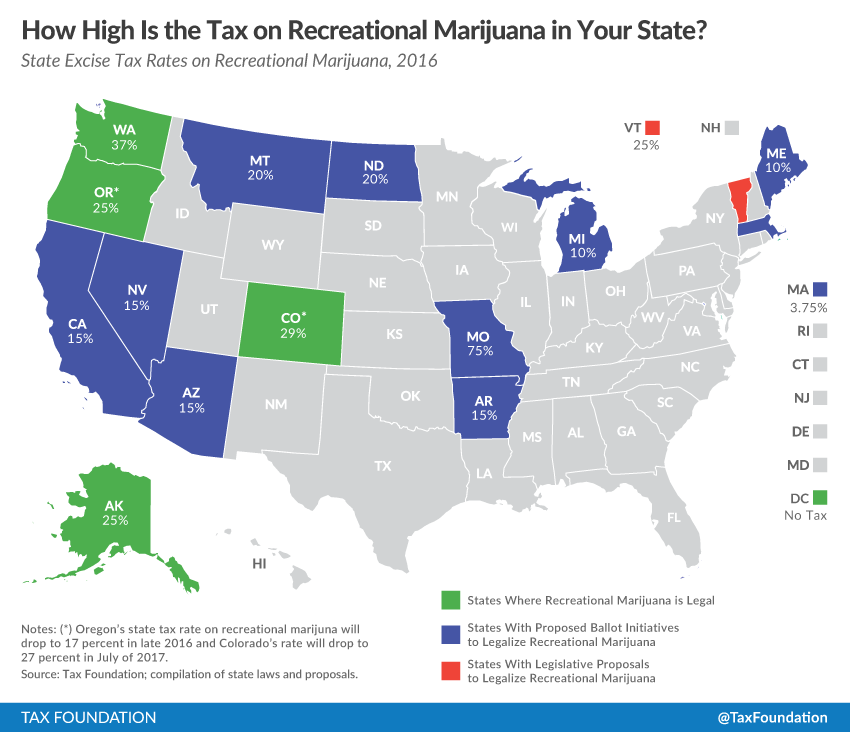

However, “if high taxes or other factors perpetuate the black market, tax collections would be less,” writes the Tax Foundation. Currently, marijuana taxes range from 25% to 37% - but, Missouri's ballot initiative to legalize the drug sets the tax at a whopping 75%.

According to a corresponding study, Colorado, Washington, and Oregon have all taken steps to lower their marijuana tax rates after initial rates around 30% did not reduce the black market sufficiently.

Neither study addresses the social costs of marijuana legalization. Combined, abuse of tobacco, alcohol and illicit drugs cost America $700 billion annually, according to the NIH.