In honor of Tax Freedom Day, Freedom Partners has put together a list of the most absurd taxes by state.

Varying from year to year, Tax Freedom Day “is the day when the nation as a whole has earned enough money to pay off its total tax bill for the year.” This year, Tax Freedom Day comes at 114 days into the year, meaning American workers must work for 114 days to pay off their total tax obligation to the government.

It's clear the government has taken some questionable liberties as it tries to earn revenue, but some of these are just ridiculous. We've put together a list of the most egregious taxes from the Freedom Partners list:

#5 Tethered Balloon Tax

If you use a hot air balloon in Kansas, it will be taxed if it's tethered to the ground. If you release the tether, you don't have to pay a tax because it is considered transportation.

#4 Toilet Flush Tax

It's hard to pick the most absurd tax coming out of Maryland, because they have so many. But the "toilet flush tax" just might be the most asinine. It's based on water consumption, and if you flush too much, you must pay.

#3 Playing Card Tax

If you want to buy a deck of playing cards in Alabama, you have to pay $0.10 to the state. This is the only state that taxes cards.

#2 Fruit Tax

If you buy fruit in California, you must pay a 33 percent tax. But there is one caveat: this only applies to fruit bought in vending machines, not grocery stores.

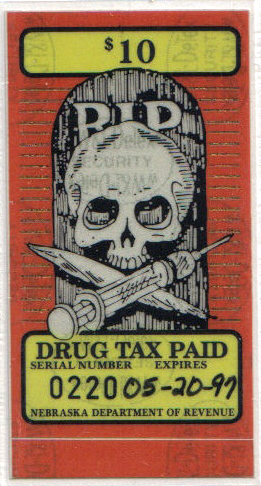

#1 Drug Dealer Tax

In Nebraska, drug dealers are required to buy a stamp that must be put on all illegal drugs.

Dealers must purchase a Drug Tax Stamp from the Department which is evidence that the drug tax has been properly paid. The dealer must permanently place sufficient stamps on each container. The stamps are not transferable, can only be used once, and expire six months from the date of purchase.-Marijuana — the drug tax is $100 per ounce or portion of an ounce.-Controlled substances — the drug tax is $150 per gram or portion of a gram.-Controlled substances not customarily sold by weight — the drug tax is $500 for each 50-dosage unit or portion of a unit.

Yes, this brings up many questions for which we have no answers. So here is a link to the law (pdf).