The percent of the nation’s Gross Domestic Product (GDP) consumed by federal spending on health insurance will grow over the next ten years, the Congressional Budget Office projects.

On Thursday, CBO released an analysis of federal government subsidizes of health insurance made to Americans through various programs and tax provisions, performed in conjunction with the Joint Committee on Taxation (JCT).

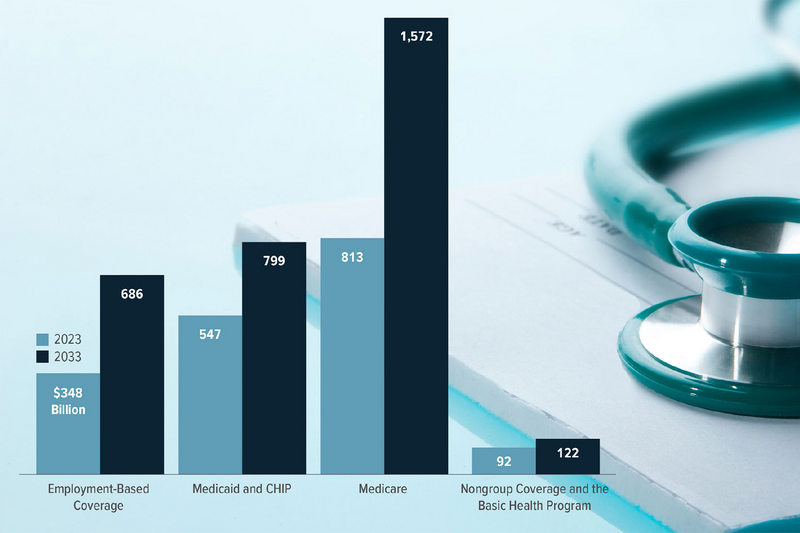

Total federal subsidies for employment-based coverage and for Medicare will nearly double from 2023 to 2033, the report projects.

Measured as a percentage of GDP, federal subsidies for employment-based coverage and for Medicare are projected to rise over the next decade, while those for Medicaid and CHIP and for nongroup coverage and the Basic Health Program are projected to decrease.

According to the CBO’s projections, net federal spending on health insurance will:

- “Grow substantially” from $1.8 trillion in 2023 to $3.3 trillion in 2033,

- Increase from 7.0% of GDP in 2023 to 8.3% in 2033.

- Increase by $25 trillion over the next ten years.

Total subsidies for employment-based coverage and for Medicare are expected to grow by seven percent annually over the 2023–2033 period. Growth in total Medicare subsidies is based on an average annual growth of five percent in the average subsidy and of two percent in enrollment.

The analysis projects that, of the $25 trillion increase in spending, nearly half will go to Medicare:

- 47% Medicare ($11.7 trillion),

- 25% Medicaid and the Children’s Health Insurance Program ($6.3 trillion),

- 21% Employment-based coverage ($5.3 trillion)

- 4% Coverage obtained through the marketplaces established by the Affordable Care Act or through the Basic Health Program ($1.1 trillion), and

- 2% Other federal subsidies ($0.6 trillion)

In CBO’s projections, the number of people 65 or older - nearly all of whom are covered by Medicare - grows significantly faster than the number of people younger than 65.

Most Americans’ health insurance is subsidized by the federal government, either through a program, such as Medicare or Medicaid, or through tax provisions.

The federal government subsidizes health insurance coverage in four main ways (listed in descending order by the number of people affected):

- By offering tax benefits for employment-based coverage to employers and employees—namely, by excluding amounts paid for health insurance premiums from income and payroll taxes;

- By providing about two-thirds of all funding for Medicaid and the Children’s Health Insurance Program (CHIP), programs aimed at insuring people with low income and people with disabilities;

- By paying for most of the cost of coverage through the Medicare program, which insures people 65 or older and people younger than 65 who have certain disabilities or end-stage renal disease; and

- By offering tax credits to eligible people who purchase nongroup coverage through the health insurance marketplaces established under the Affordable Care Act (ACA), as well as by covering much of the cost of coverage through a Basic Health Program, which states can establish under that law.

The business and economic reporting of CNSNews is funded in part with a gift made in memory of Dr. Keith C. Wold.