As of July, Americans are saving less – and more than half are living paycheck-to-paycheck – new reports reveal.

“61% of Americans are living paycheck to paycheck — inflation is still squeezing budgets,” CNBC reported on Thursday, citing a new Lending Club study on July 2023 consumer trends.

Also on Thursday, the U.S. Bureau of Economic Analysis (BEA) released its “Personal Income and Outlays” report for July, revealing that Americans’ average personal savings rate fell from 4.3% in June to 3.5% in July.

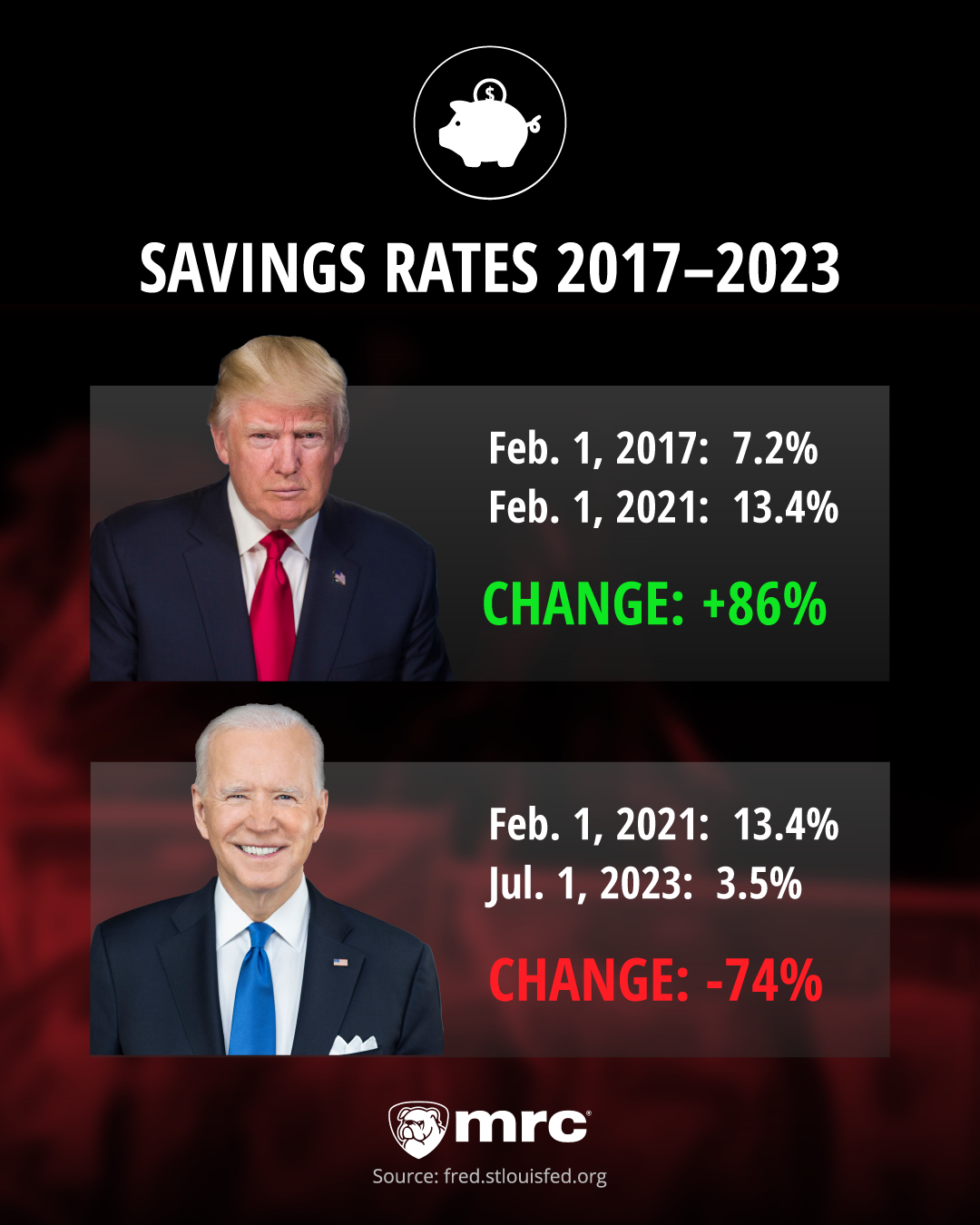

July’s 3.5% savings rate is a mere quarter of its 13.4% level when former Pres. Donald Trump left office and more than twice the 7.2% savings rate recorded during Trump’s first full month in the White House.

Adjusted for inflation, “real” disposable personal income (DPI) for July - personal income less personal current taxes – fell, compared to the previous month, the BEA reports:

- Total personal income increased $45.0 billion, at a 0.2% monthly rate, in July.

- Disposable personal income was virtually unchanged from June.

- “Real” disposable personal income decreased 0.2% for the month.

- “Real” personal consumption expenditures increased 0.6% in July, reflecting increases of 0.9% in spending on goods and 0.4% in spending on services.

- The Personal Consumption Price Index increased 0.2%, compared to the previous month.

The business and economic reporting of CNSNews is funded in part with a gift made in memory of Dr. Keith C. Wold.